Value Added Tax (VAT)

Value Added Tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution.

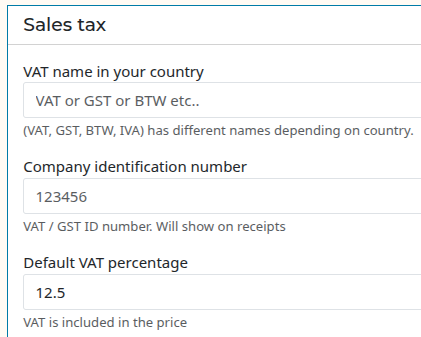

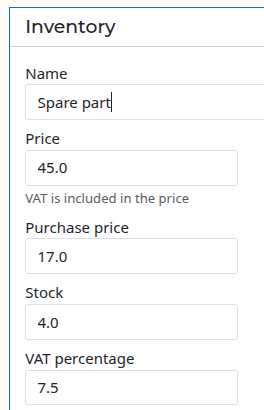

In Repero you can rename the Sales Tax so it has the right name on your invoices, and you can set a default VAT percentage that will be applied to all products and services in your inventory.

You can also set different VAT percentages for specific products or services if needed.

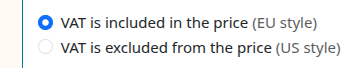

Sometimes it is added on top of the sale price, while in other cases it is included in the sale price.

Repero supports both methods of VAT calculation.

VAT is typically a percentage of the sale price and is collected by businesses on behalf of the government.

It is commonly used in many countries around the world as a way to generate revenue for public services and infrastructure.

VAT is called different names in different countries, for example, in the United States, it is known as Sales Tax. In the UK it is called VAT (Value Added Tax), in Canada it is called GST (Goods and Services Tax) or HST (Harmonized Sales Tax), and in Australia, it is known as GST (Goods and Services Tax). In Spain it is called IVA (Impuesto sobre el Valor Añadido), in France it is known as TVA (Taxe sur la Valeur Ajoutée), and in Germany, it is referred to as Mehrwertsteuer (MwSt).

Source: Wikipedia